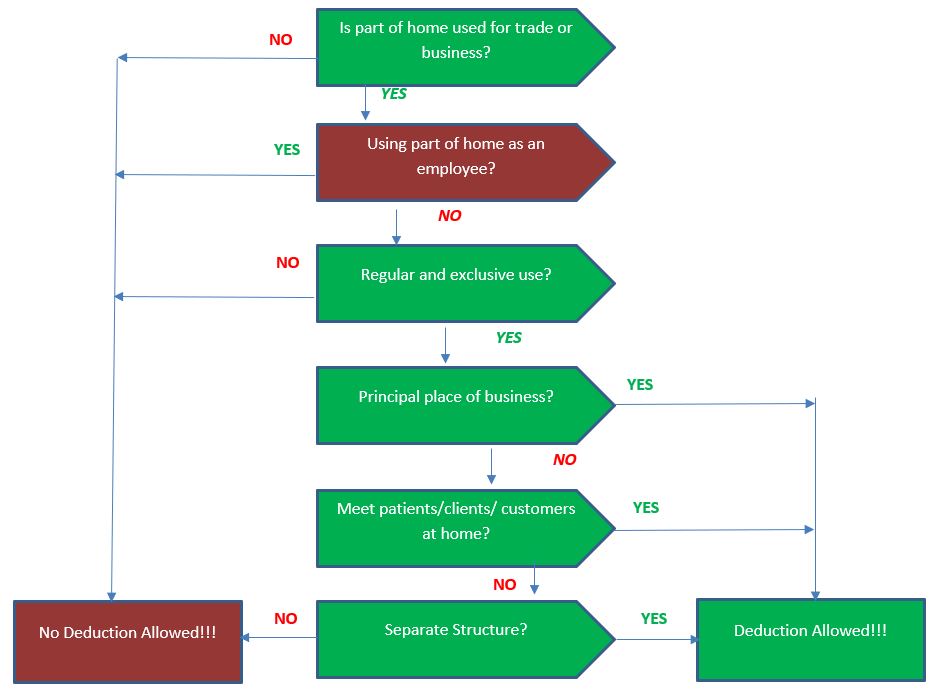

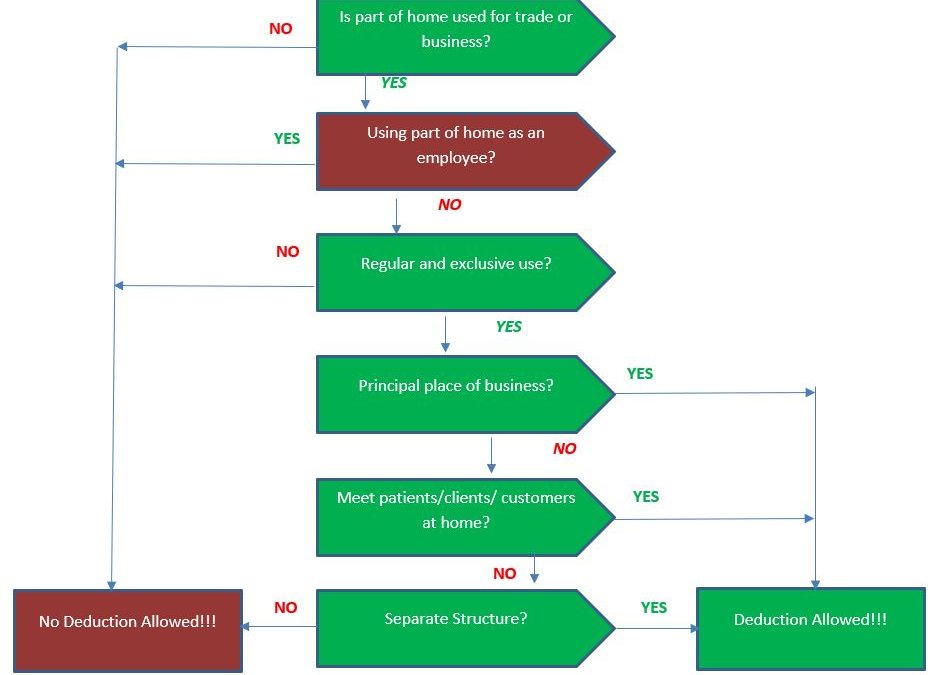

Under IRS publication 587, you can deduct items related to your residence as a legitimate tax expense. These items include mortgage interest, real estate taxes, utilities, maintenance, rent, depreciation, or property insurance. However, to qualify as a deductible expense, one must use part of ones home:

1. Exclusively and regularly as your principal place of business (see Principal Place of Business, later);

2. Exclusively and regularly as a place where you meet or deal with patients, clients, or customers in the normal course of your trade or business;

3. In the case of a separate structure which is not attached to your home, in connection with your trade or business;

4. On a regular basis for certain storage use (see Storage of inventory or product samples, later); For rental use (see Pub. 527); or

5. As a daycare facility (see Daycare Facility, later).

The following flowchart can help determine if you can deduct business use of the home expense: